Imagine having complete control over your finances right at your fingertips, with the added peace of mind that your sensitive information is safe and secure. Mobile banking apps have revolutionized the way you manage your money, but not all apps are created equal.

When it comes to protecting your financial data, security is everything. You don’t want to leave your hard-earned money vulnerable to cyber threats. That’s why it’s essential to choose apps that prioritize top-notch security features. Are you ready to discover which mobile banking apps offer the highest level of protection for your peace of mind?

Dive into our carefully curated list to ensure your financial safety today.

Importance Of Security In Mobile Banking

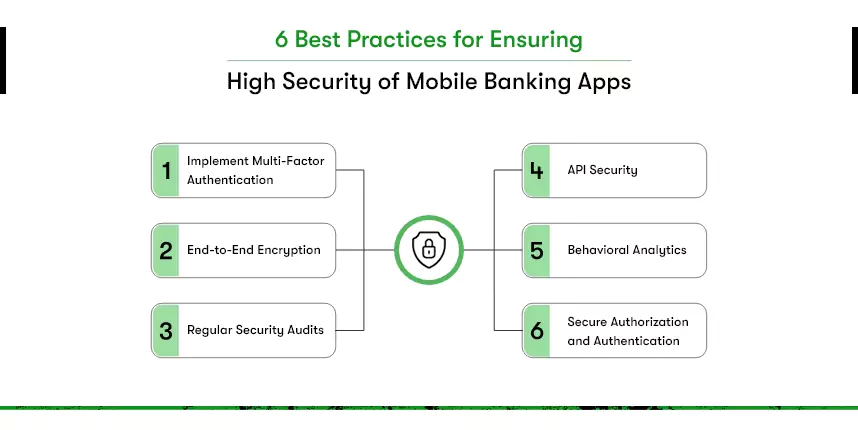

Mobile banking apps need strong security. Protecting user data is crucial. Banks use many tools to keep data safe. Encryption is one key tool. It hides data from hackers. Multi-factor authentication is another method. It uses more than one step to log in. This makes it harder for thieves.

Regular updates help keep apps safe. Updates fix security holes. Always use the latest app version. Biometric security like fingerprints adds another layer. It uses your unique traits. These measures build trust with users. They feel safe with their money.

Key Security Features In Mobile Banking Apps

Biometric authentication uses unique body features. Fingerprints are common. Face recognition is another option. These methods are very safe. They are hard to fake. Only you can access your account.

Two-factor authentication makes accounts safer. It needs two proofs to log in. First is your password. Second is a code sent to your phone. This code changes each time. Extra layer of security protects your account.

Data encryption keeps information safe. It turns data into code. Only special keys can read this code. Banking apps use strong encryption. Your details stay private. Hackers cannot see them.

Top Mobile Banking Apps With Robust Security

App A uses strong encryptionto keep data safe. It offers two-factor authenticationfor extra protection. Users can set up biometric loginlike fingerprint or face recognition. The app checks for suspicious activityand alerts you. Regular updates fix any security bugs. Your money stays securewith App A.

App B provides end-to-end encryptionfor safe transactions. It supports multi-level authenticationmethods. Users can use voice recognitionfor logging in. The app has real-time monitoringto track unusual behavior. Frequent updates ensure security patchesare applied. Trust App B for a securebanking experience.

App C offers advanced encryptiontechniques. It enables secure loginwith biometrics. Users get notified of any unauthorized attempts. The app performs regular security audits. Updates keep the app securefrom threats. Feel safewith App C.

.webp?width=1201&name=New-Reworks_INFOGRAPHIC_Dec-21_Update-1%20(1).webp)

Comparing Security Protocols Of Leading Apps

Mobile banking apps need strong security. Encryption is a key feature. It keeps your data safe. Many apps use two-factor authentication. This adds an extra layer of security. Biometric authentication is also used. This includes fingerprints or face scans. These features help protect your money.

Some apps offer real-time alerts. They inform you of suspicious activities. Others have automatic logouts. This happens after a period of inactivity. Regular updates ensure the apps stay secure. They fix any new threats quickly.

Choose apps with high user ratings for security. Check their reviews for insights. A secure app keeps your bank details safe. Always read their privacy policies. It’s important to know how they protect your data.

How To Protect Your Mobile Banking Experience

Keep your mobile banking app secure. Use a strong, unique password. Combine letters, numbers, and symbols. Change it every few months. Avoid simple passwords like “123456”.

Enable two-factor authentication(2FA). This adds an extra security layer. You’ll need a code sent to your phone. This prevents unauthorized access.

Update your app and phone often. New updates fix security holes. Don’t delay these updates. They keep your information safe.

Phishing tricks people into giving personal info. Look for strange emails or messages. They might ask for your banking details.

Banks never ask for details via email. Always check the sender’s email address. Look for spelling mistakes. Be cautious with links. They might lead to fake websites. Stay alert and protect your data.

The Future Of Security In Mobile Banking

Mobile banking appsare becoming more popular. They need strong security. Emerging technologiescan help make them safer. One new technology is biometric authentication. This uses fingerprints or face scans. It helps keep accounts safe. Another technology is AI-powered security. It detects unusual activity quickly. This can stop fraud early. Blockchain technologyis also promising. It stores data safely, preventing tampering. These technologies make banking apps more secure.

Potential security threatsstill exist. Hackers use malware to steal information. They find weak spots in apps. Phishing attacks trick users into giving passwords. Public Wi-Fi can be risky. It makes stealing data easy. Old software is also a problem. It may have security holes. Banks work hard to fix these issues. They update apps often. Customers must stay alert. Don’t share passwords. Use strong passwords.

Frequently Asked Questions

What Is The Most Secure Banking App?

Choosing the most secure banking app depends on individual needs. Popular options include Bank of America, Wells Fargo, and Chase. They offer advanced encryption and biometric authentication features. Always verify security features and reviews before downloading any banking app.

What Is The 1 Mobile Banking App?

The 1 mobile banking app varies by region and user preference. Some top contenders include Chime, Revolut, and N26. They offer user-friendly interfaces, robust security, and innovative features, making them popular choices for digital banking. Always check current ratings and reviews for the latest rankings.

What Is The Most Trustworthy Online Bank?

Chime, Ally Bank, and Discover Bank are often considered trustworthy online banks. They offer secure platforms, competitive rates, and excellent customer service. Always check user reviews and current ratings to ensure reliability.

What Is The Safest Device To Do Online Banking?

Use a dedicated laptop with updated security software for online banking. Ensure it has a secure internet connection. Keep the operating system and browser updated. Avoid using public Wi-Fi networks. Regularly scan for malware. These practices enhance the security of your online banking activities.

Conclusion

Choosing a secure mobile banking app is crucial for your peace of mind. These apps ensure your money and data stay protected. Always update your app for the latest security features. Regular updates fix vulnerabilities and enhance safety. Verify app permissions to safeguard your personal information.

Trust only reputable apps with good reviews. Prioritize security settings like two-factor authentication. They add an extra layer of protection. Strong, unique passwords are essential. Avoid using the same password across different apps. Stay informed about the latest security trends.

Your financial safety depends on it. Make informed choices and keep your finances safe.

Read More:

- Best Antivirus Software for Windows 2025: Ultimate Guide

- Metaverse Investment Opportunities USA: Unlocking Future Wealth

- Best Vpn for Usa Streaming Services: Unblock & Enjoy!

- Iphone 16 Pro Max Full Review: Ultimate Guide Unveiled

- Smart Locks With Fingerprint Recognition: Secure Your Home

- Ultra-Thin Laptops With Long Battery Life: Sleek & Powerful

- Ai-Powered Personal Finance Apps: Revolutionize Budgeting

- Cloud Storage Services for Professionals: Maximize Efficiency